Outgoing Washington Insurance Commissioner Mike Kreidler says listening is No. 1 task of the elected position

January 13, 2025

- These 10 Used Cars Will Have You Paying Outrageous Insurance Prices

- Old Republic launches new cyber insurance subsidiary

- Husband of ‘The View’ host named in sweeping insurance fraud case likely to see years of court action

- Telematics on the rise in trucking insurance underwriting

- Anthem customers will remain in network at OSU Wexner Medical Center

In the latest Washington State Office of the Commissioner’s “OIC Answers” podcast, Commissioner Mike Kreidler said the best advice he could give to his successor Patty Coer is to “listen carefully to people.”

Bạn đang xem: Outgoing Washington Insurance Commissioner Mike Kreidler says listening is No. 1 task of the elected position

The episode focused on what the OIC and the commissioner do and how the insurance industry has changed throughout Kreidler’s 24-year tenure. Kreidler didn’t seek reelection and plans to retire. Coer will take office this month.

“She’s already shown remarkable talent in this regard as a legislator,” Kreidler said. “Listening to the consumer… and if they’re having problems, which more often than not they are, then you want to be able to respond quickly and appropriately. I think that’s the best thing you can do, just be a good listener.”

He said the best part of the job is solving problems for consumers “even if it means perhaps having some strong words with an insurance company and pointing out that, ‘No, it’s the law in the state of Washington. This is what you have to do.”

“If they have a different interpretation, we can settle it in a courtroom or you can acknowledge the fact that you have a responsibility here. And more often than not, they would prefer not to go to court to have it resolved. They’d solve it right there and come up with a workable conclusion for the consumer.”

Kreidler credited his office staff’s dedication and hard work as making it possible for insurance companies to “consider the error of their ways.”

He shared the outcome of a complaint that stood out most to him during his time in office. A woman came to the OIC for help because she felt she was out of options. While she was driving for work, she was in a car crash and as a result, was permanently disabled. She hadn’t received any worker’s compensation benefits, according to Kriedler. The OIC was able to investigate her complaint, ultimately leading to a six-figure settlement, he said.

“She had a compelling story, and the insurance company was just plain wrong,” Kreidler said.

When Kreidler came into office in 2000, the office had lost its National Association of Insurance Commissioners (NAIC) accreditation, had outdated equipment and systems, and the individual health insurance market had collapsed in the state.

Xem thêm : 3 P&C Insurance Stocks That Have Gained More Than 50% in 2024

“It was here [OIC] where I had a chance to really have the rubber meet the road,” Kreidler said. “This is where you had a chance to really take on some of these tough issues and bring about some changes, particularly around health insurance. And I was in a position to make that happen. It took time but we were able to do it.”

The improvements, he added, included doubling the size of the OIC Consumer Protection team.

“We wound up with a lot more people who were prepared to answer telephones and respond to inquiries coming from consumers,

he said.

The Washington legislature also established OIC’s Criminal Investigations Unit at the nudging of Kreidler.

“I’d say the major driver was certainly some of the news coverage that was coming out about some of the staged automobile accidents and the problems around that because it tended to be much more kind of a gang type of activity, multiple players,” he said. “It was organized. We effectively had no way of being able to react to that.”

A witness who testified in favor of legislation to create the department ran a fraud department in the California insurance commissioner’s office.

“He found it very easy to come up here to the state of Washington to testify in favor of creating a separate fraud division because he was coming up here to pick up somebody who was actively involved in fraudulent activity with staged Ottawa accidents, and was not going to get arrested and prosecuted in the state of Washington,” Kreidler said. “They were taking him back to California where they had him dead to rights and they would prosecute him there. That made quite an impression on the legislature, all of a sudden, that California was upping us that much — that we were not in a position to be able to really take care of our own.”

Since he first took office, Kreidler said the insurance industry has changed drastically. The biggest change he’s noticed is the “sophistication” of rate filings from insurers, he said.

“It drives me crazy that they sometimes get angry that they said, can’t you deal with these our filings quicker? Can’t you get our approval? Well, they come in with an entirely new program that is untested and they want us to take it on blind faith that this is good for the consumers in the state of Washington,” Kreidler said.

“I’m very reluctant. In fact, I strongly resist being railroaded into an approval process where we have not done a thorough job of making sure that what they want to market is going to be good for consumers and the sophistication of the products that they are putting forward or making it much, much more difficult for insurance regulators across the country… I think the survey work that we do with the companies and where they have to report what they are doing as an insurance company provides incentive for them to recognize that maybe they need to look at things a little bit more globally rather than just at a particular project and how much they’re going to make from it.”

In 2023, the OIC sought feedback on why auto and home insurance complaints had been on the rise since 2021, mostly in auto. Kreidler said most of the complaints were about auto insurance carriers using photo estimating to produce very low repair estimates, not sending adjusters to conduct in-person damage inspections, and not thoroughly explaining why they disagreed with estimates policyholders were given.

Xem thêm : Waymo’s driverless cars are apparently an insurance company’s dream

OIC said it asked multiple insurance company vendors that develop and use photo software and artificial intelligence (AI) to create repair estimates to participate in the workshop. None of them responded to the request.

The OIC Consumer Advocacy Program received 467 complaints in April 2023, up from the historic average of 287 a month — a 63% increase.

During a workshop held by OIC in July 2023, the Washington Independent Collision Repairer’s Association (WICRA) questioned the office’s accountability.

According to WICRA’s survey data, only 6.9% of nearly 1,100 photo-based claims were paid in full by insurers without supplements and only 26 of them were accurate.

The survey was on photo estimating — its accuracy, the claims handling process, and the length of time from keys to keys. Questions were sent to more than 65 independent collision repair shops and 30 responded.

Earlier this week, a separate Department of Insurance shared details on the recovery of more than $9.4 million last year for residents, mostly having to do with auto insurance complaints.

Nevada Division of Insurance Consumer Services successfully closed 4,194 consumer complaints including 2,100 auto insurance claim complaints. The division told Repairer Driven News the broad categories of most complaints received and pursued by the division are payment disputes and unfair denial of claims and coverage. The complaints resolved in 2024 added up to $3.3 million recovered for auto claims.

The Division’s Consumer Services and Investigations teams investigate thousands of consumer complaints annually, assisting Nevadans in resolving disputes with their insurance providers, a press release says. These efforts often result in financial recoveries for consumers, ensuring they receive the benefits and services owed under their insurance policies.

“The accomplishments of the Consumer Services section this year are truly outstanding,” said Commissioner Scott Kipper, in the release. “Their dedication to resolving consumer issues has resulted in recoveries that surpass previous Fiscal Year records, further highlighting the Division’s unwavering commitment to protecting Nevada consumers.”

Images

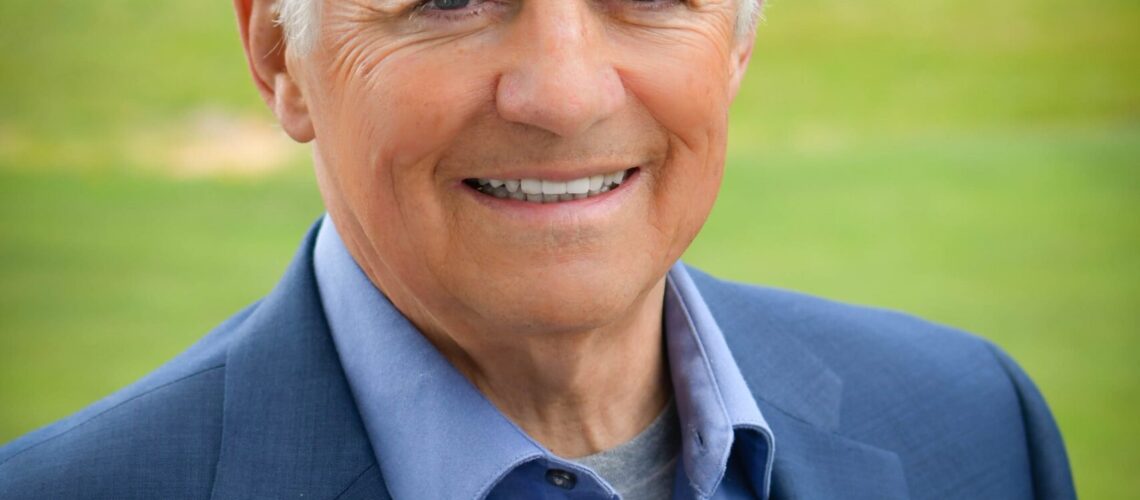

Featured image: Washington State Insurance Commissioner Mike Kreidler (Provided by Washington State OIC)

Share This:

Related

Nguồn: https://propertytax.pics

Danh mục: News