California insurance commissioner issues 1-year moratorium to protect Southern California homeowners

January 10, 2025

- Sansum/Sutter and Anthem Reach Agreement on Health Insurance Contracts for 2025

- Scripps Health out of network for Anthem policyholders – NBC 7 San Diego

- Chubb names new claims head for overseas general insurance

- Thornton Township, Illinois trustees deny Henyard quorum again amid fight over lapsed insurance

- Trump Should Let the Costly Obamacare Subsidies Expire

Bạn đang xem: California insurance commissioner issues 1-year moratorium to protect Southern California homeowners

The California insurance commissioner issued a mandatory one-year moratorium on non-renewals and cancellations to protect Southern California residents affected by the recent fires.

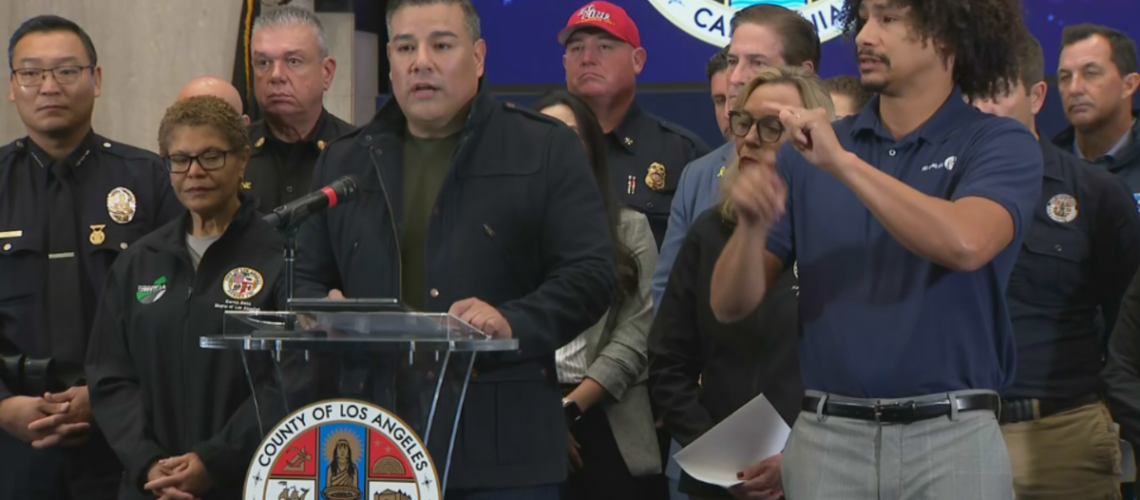

At a news conference on Friday, Commissioner Ricardo Lara said his primary concern is to make sure residents who are affected by the fires get the full insurance benefits they are entitled to.

Xem thêm : Stephens Insurance Announces Leadership Transition

KCAL News

“Last night I issued a bulletin to protect homeowners affected by the Palisades and Eaton fires from non-renewals and cancellations by your insurance companies for one year,” Lara said.

Lara issued the moratorium on Thursday as the region continues to be wrecked by several fires that have burned over 36,000 acres. His moratorium applies to the zip codes around the Palisades and Eaton fires as well as adjacent areas. It will cover homeowners even if their homes weren’t destroyed or damaged.

“I’m also calling on insurance companies to suspend any pending non-renewals and cancellations that homeowners received before these fires started,” Lara said. “This means that if you received a non-renewal from your homeowner’s insurance between Oct. 9 and Jan. 7, essentially 90 days, your insurance company should do the right thing and retain you as a valued policyholder.”

Lara’s moratorium comes as thousands of Los Angeles homeowners were dropped by insurers before the Palisades Fire erupted. CNS MoneyWatch reported that about 1,600 policies in the Pacific Palisades area were dropped by State Farm in July.

To provide additional support to those affected, Lara called on insurers to extend their 60-day grace period for homeowners to pay their insurance premiums.

Xem thêm : New law increases California’s auto insurance minimums

At the conference, Lara said people are also facing issues with health insurance. He has issued a notice to all California health insurers directing them to submit emergency plans to his department.

“These plans must detail how they’re going to ensure that consumers can continue to access essential medical care and obtain their medications in the wake of these disasters,” Lara said.

Beyond just helping homeowners, Lara intends to introduce new legislation to protect business owners in his moratorium law.

His office will be hosting two free insurance support workshops. One will be in Santa Monica on Jan. 18 and 19 the second will be hosted in Pasadena on Jan. 25 and 26.

Nguồn: https://propertytax.pics

Danh mục: News