AI, ESG, and cyber will be the key insurance themes in 2025

December 16, 2024

- HUD Announces Adjustments to Help Properties Address Rising Expenses and Insurance Costs

- Report: Oklahoma’s changing climate is largely to blame for insurance troubles

- Germany’s Allianz withdraws offer to acquire Singapore’s Income Insurance

- More Coloradans reveal insurance company incorrectly billed them for “hidden” drivers

- Update on Historic Use of Crop Insurance Products in Illinois

Artificial intelligence (AI) is clearly the standout theme in the insurance industry, as generative AI continues to open up business opportunities. Meanwhile, environmental, social, and governance (ESG) and cyber will also be key in 2025, according to GlobalData’s Insurance Predictions 2025 webinar. The webinar— utilising findings from GlobalData surveying—found that global consumers are open to embracing AI, do care about the issue of sustainability, and are interested in personal cyber insurance policies.

Bạn đang xem: AI, ESG, and cyber will be the key insurance themes in 2025

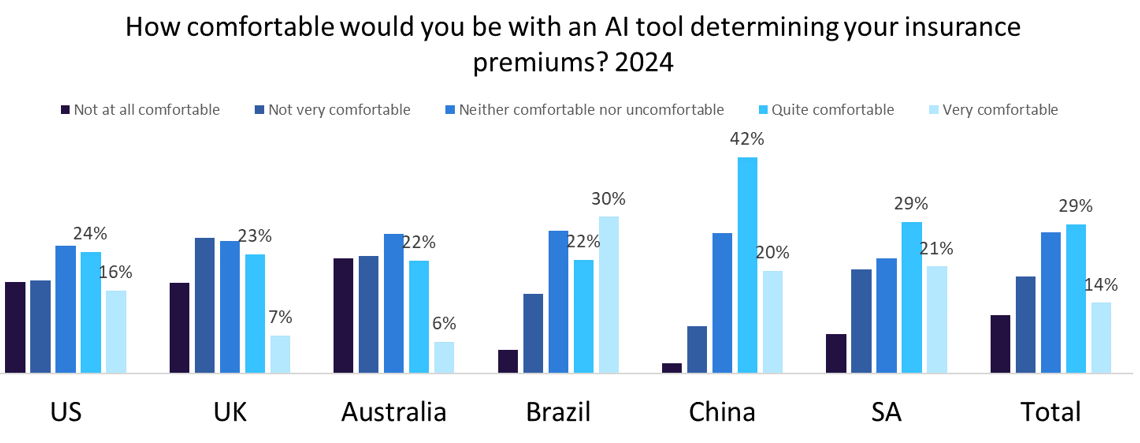

GlobalData’s 2024 Emerging Trends Insurance Consumer Survey found that insurance customers around the world are willing to try AI tools in all areas of the value chain. The chart below shows attitudes towards using AI tools to determine premiums, highlighting that 43% of global users are either quite or very comfortable using such tools. There is some variation from region to region—for example, Chinese consumers are clearly the most open to this technology, while Australians are least open—but insurers should be utilising them in every geography. Enough consumers are already comfortable with AI tools that they can provide an effective (and 24/7) channel of communication, thus reducing stress on phone lines and email accounts.

The webinar also discussed personal cyber insurance. Cyber insurance overall is undoubtedly one of the biggest themes in insurance, but personal cyber is far less prominent than commercial cyber. However, there does appear to be an opportunity here for insurers. One finding from GlobalData’s 2024 Emerging Trends Insurance Consumer Survey was that 15.5% of consumers have a form of personal cyber insurance, but a further 26.4% would be interested in such a policy. For 18–24-year-olds that proportion increases to 35.7%, which highlights the scale of opportunity if insurers can balance competitive pricing with not exposing themselves to too much risk in a line that has been notably difficult to price in recent years.

While we expect AI, ESG, and cyber to be the leading themes in the insurance industry in 2025, there will be plenty of other influential ones. Personalisation is always a leading theme, and insurers that can offer tailored products in personal and commercial lines will see great success. Electric vehicles, embedded insurance, and the Internet of Things will also be key themes to watch out for.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Thank you!

Xem thêm : Will new regulations resolve CA’s home insurance crisis?

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Nguồn: https://propertytax.pics

Danh mục: News