Update on Historic Use of Crop Insurance Products in Illinois

December 18, 2024

- Concord Monitor – Opinion: Changing the conversation around insurance

- How Luigi Mangione’s Notebook Helped Prosecutors

- Suspect Charged With Killing Insurance Company’s CEO as an Act of Terrorism | News, Sports, Jobs

- Military families concerned about insurance cuts at Children’s Hospital

- Medical professionals frustrated with health insurance

Revenue Protection (RP) remains the most popular crop insurance plan used by Illinois farmers to insure their corn, soybean, and wheat acreage. In 2024, RP was used on 95% of insured corn acres and 94% of insured soybean and wheat acres. The use of the Supplemental and Enhanced Coverage Options (SCO and ECO) on eligible acres covered by COMBO products (RP, RP-HPE, and YP) remains relatively modest. Use of ECO on corn acres in Illinois has increased in recent years. Use of ECO could increase further in 2025 due to increased subsidy rates.

Bạn đang xem: Update on Historic Use of Crop Insurance Products in Illinois

Federal Crop Insurance Plans Available for Corn, Soybeans, and Wheat

In 2011, RMA introduced the COMBO product, which consolidated predecessor plans for providing crop insurance based on farm yields. The COMBO product provides three plans differing in the type of insurance provided:

- Revenue Protection (RP) provides revenue insurance that allows the guarantee to increase during years when prices at harvest (i.e., harvest prices) are higher than those used to set guarantees prior to planting (i.e., projected prices).

- RP with the harvest price exclusion (RP-HPE) also provides revenue protection, but the guarantee uses projected prices without the possibility of a guarantee increase.

- Yield Protection (YP) provides yield protection. If yields fall below a guarantee, YP will make payments with yield losses valued at the project price.

In addition to the COMBO product, RMA also has products that make payments based on county-level yields. For these insurance products, yields on a farm do not matter. RMA administers area plans through the Area Risk Protection Insurance (ARPI) policy. Three plans of insurance mirror the COMBO plans:

- Area Revenue Protection (ARP) provides revenue protection with the possibility of a guarantee increase. It is similar to RP but uses county yields.

- ARP with the harvest price exclusion (ARP-HPE) provides revenue protection without the possibility of a guarantee increase, similar to RP-HPE, but using county yields.

- Area Yield Protection (AYP) provides yield protection similar to YP but using county yields.

In addition to the COMBO and ARPI policies, Margin Protection (MP) was introduced in 2018. MP is a county-level product that provides margin protection with or without the harvest price exclusion. MP can be combined with RP and RP-HPE. More information on MP is available in a farmdoc daily article published on September 8, 2017, with an update on MP experience published on August 30, 2022.

Farmers have seven plans for providing multi-peril insurance outlined above. In addition, farmers have two area “add-up” or “companion” insurance plans that can provide supplemental coverage to the farm-level COMBO products:

- Supplemental Coverage Option (SCO) is available as an add-on to COMBO plans (i.e., RP, RP-HPE, and YP). SCO provides county coverage from an 86% coverage level down to the COMBO plan’s individual coverage (see farmdoc daily articles from February 27, 2014, April 24, 2014, and February 12, 2019 for more information on SCO).

- Enhanced Coverage Option (ECO) is another add-on plan to COMBO products that became available in 2021. ECO provides protection from 90% or 95% down to 86%, the point at which SCO begins its coverage. (see farmdoc daily articles from November 24, 2020 and February 23, 2021 for more information on ECO).

Product Use in Illinois

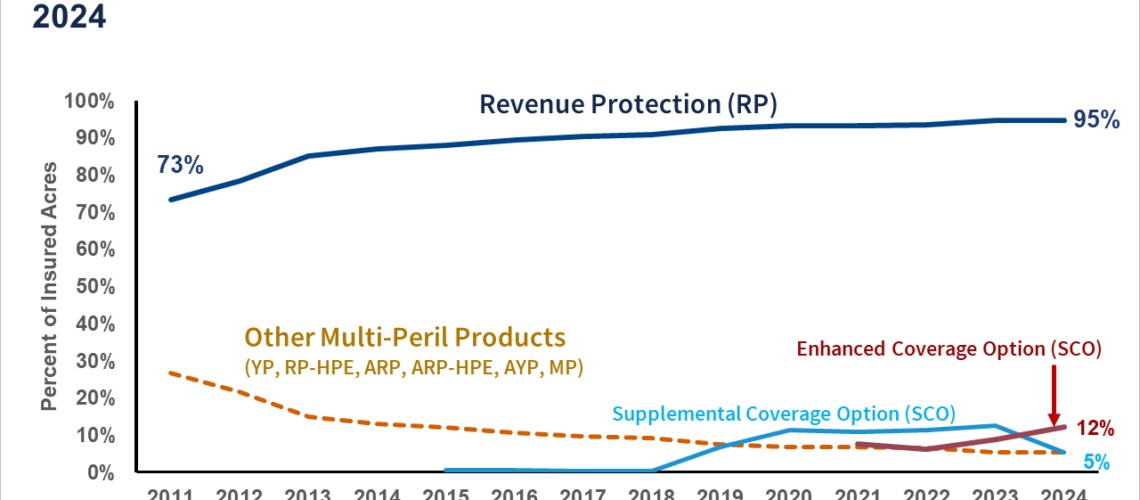

Figure 1 illustrates the share of insured corn acres covered under the major multi-peril insurance programs from 2011 to 2024.

RP continues to be the most popular insurance program used by farmers in Illinois (see farmdoc daily from November 17, 2020). Corn acres covered under RP have increased from 73% in 2011 to over 90% in 2017. The RP share has continued to increase, reaching 95% for both 2023 and 2024. The share of insured acres under other multi-peril products has declined from 27% in 2011 to just 5% in 2024.

Xem thêm : 4 million could lose health insurance if ACA tax credits expire

The use of SCO and ECO, which require underlying coverage from one of the COMBO plans (RP, RP-HPE, or YP) has remained modest since their introduction in 2014 (SCO) and 2021 (ECO). As of 2024, 5% of corn acres carried SCO coverage while 12% of corn acres were covered under ECO. The use of ECO on corn acres in Illinois has been increasing in recent years, and use could increase further in future years as the subsidy rate will increase for the 2025 insurance year (see farmdoc daily from November 5, 2024).

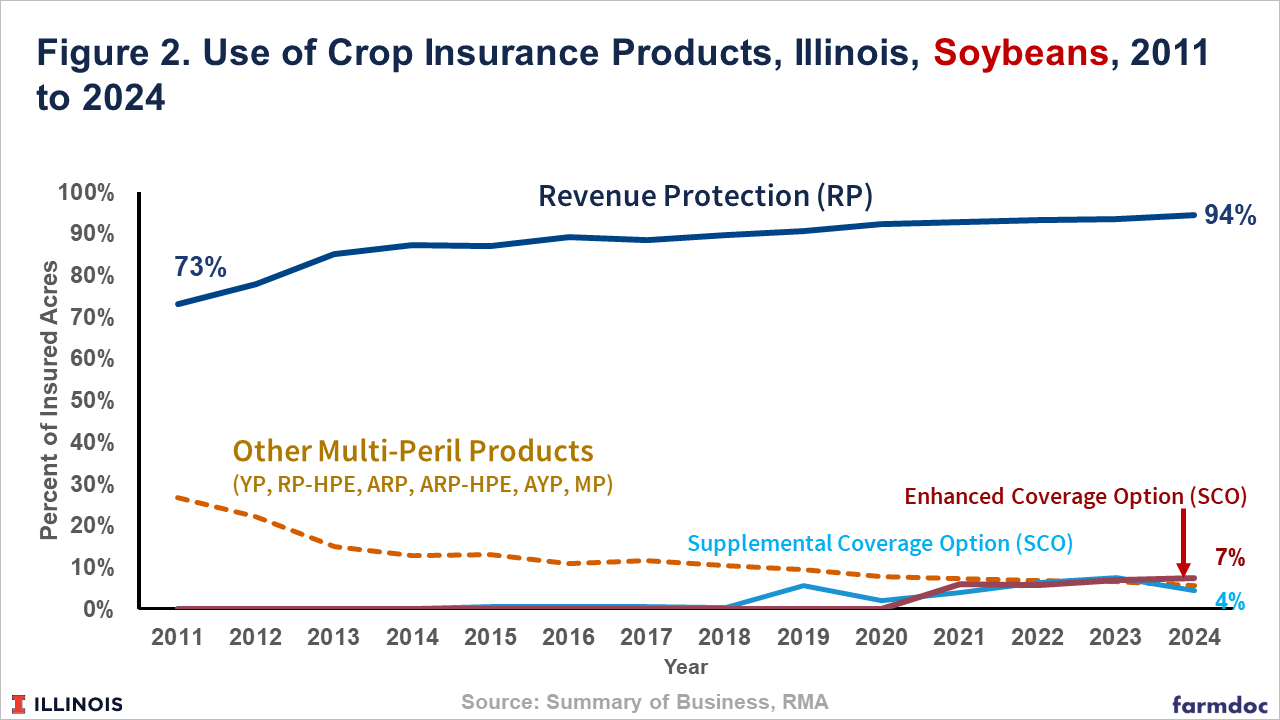

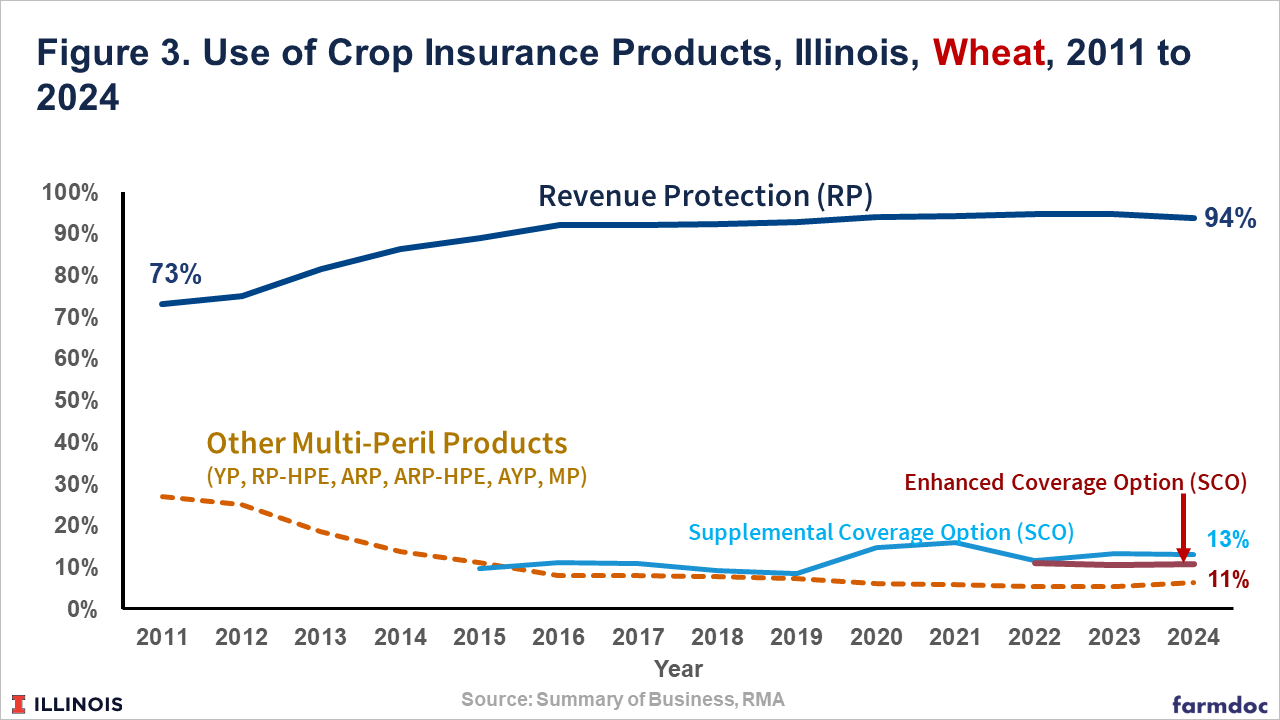

Insurance plan use on soybean and wheat acres in Illinois are similar to that for corn acres (see Figures 2 and 3). RP is also the most popular insurance plan for soybeans and wheat in Illinois, with 94% of soybean and wheat acres covered under RP in 2024. RP’s acreage share reached 90% for soybeans in 2018 and for wheat in 2016. Similar to corn, RP’s share has continued to increase for soybeans and wheat, but at slower rates, to current levels in 2024.

SCO and ECO was used on 4% and 7% of soybean acres, respectively, in Illinois in 2024. For wheat, SCO was used on 13% of insured acres in 2024 while ECO was used on 11% of insured acres. The slightly higher use of SCO on wheat acres, compared with corn and soybeans, likely reflects the higher enrollment rate of wheat base acres in the Price Loss Coverage (PLC) program. Unlike SCO, ECO does not require use of PLC, and can be used without SCO. Strategies that only use ECO and not SCO may be worth considering.

Summary

RP continues to be the most popular crop insurance product used by corn, soybean, and wheat farmers in Illinois. This reflects a strong preference among producers for farm-level revenue coverage that includes a guarantee increase if prices increase between spring and harvest. The similarities in RP’s acreage share through time for all three crops suggests farmers have preferred insurance coverage that does not differ across crops.

While use of the more recently introduced supplemental area plans, SCO and ECO, has remained relatively low, the use of ECO on corn acres in Illinois has been increasing since 2022. With subsidy rates set to increase for the 2025 crop year, use of the ECO product is expected to further increase on corn, soybean, and wheat acres in Illinois. Again, ECO can be used without SCO.

References

Paulson, N. and J. Coppess. “2014 Farm Bill: The Supplemental Coverage Option.” farmdoc daily (4):37, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 27, 2014.

Xem thêm : US is raging about private health insurance trap. We shouldn’t fall into it

Paulson, N. and J. Coppess. “Further Discussion of the Supplemental Coverage Option.” farmdoc daily (4):75, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 24, 2014.

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. “The New Enhanced Coverage Option (ECO) Crop Insurance Program.” farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Schnitkey, G. “Margin Protection Insurance.” farmdoc daily (7):165, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 8, 2017.

Schnitkey, G. “Supplemental Coverage Option: An Insurance Option Available to More Farmers.” farmdoc daily (9):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 12, 2019.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. “Revenue Protection: The Most Used Crop Insurance Product.” farmdoc daily (10):198, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 17, 2020.

Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. “Potential Payouts from Enhanced Coverage Option.” farmdoc daily (11):27, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 23, 2021.

Swanson, K., G. Schnitkey, R. Batts, C. Zuluaf, N. Paulson and J. Baltz. “Margin Protection: Description and a Review of Experience.” farmdoc daily (12):131, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, August 30, 2022.

Schnitkey, G., N. Paulson, C. Zulauf, B. Sherrick and B. Goodrich. “Impacts of Higher Premium Support Rates on ECO Performance.” farmdoc daily (14):201, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 5, 2024.

Nguồn: https://propertytax.pics

Danh mục: News