Dramatic Insurance Spikes Could Tank California’s Homeless Housing

December 17, 2024

- Herald-Tribune newspaper hopes to empower homeowners via information

- How Luigi Mangione’s Notebook Helped Prosecutors

- MHA names Ahmer Khan as head of insurance

- Insurers Are Dropping Homeowners as Climate Shocks Worsen

- Op-ed | One way health insurance companies seem to profit off patients over the phone

“Those are the exact same things that are being cited as risk drivers,” she said. “Things like greater density, things like infill, things like serving folks at the lowest incomes.”

Bạn đang xem: Dramatic Insurance Spikes Could Tank California’s Homeless Housing

Industry experts say increasing premiums are the result of greater weariness on the part of insurance carriers to take on what they consider to be riskier properties, especially as they also confront higher rebuilding costs, more frequent losses from natural disasters, and other challenges.

“The industry has been unprofitable,” said Karen Collins, Vice President of Property and Environmental at the American Property Casualty Insurance Association. “So we are seeing premiums having to increase across the entire U.S.”

But, unlike other landlords, who can pass increased costs onto tenants, supportive housing providers face strict limits. Rents are typically capped at 30% of residents’ incomes; taxpayer subsidies cover the rest.

California’s Insurance Commission has only just begun to study the problem, said Tony Cignarale, Deputy Commissioner of Consumer Services and Market Conduct. He’s been meeting with supportive housing providers over the past few months, he said, to gather information and get a “broad picture to find a solution, either administrative or legislative.”

In the meantime, Marcus said some housing providers may not be able to wait for a solution that could be a year or more in the making.

“Insurance costs, especially in combination with other operational cost challenges, are posing an immediate financial — I would say existential — risk,” she said.

A promising solution

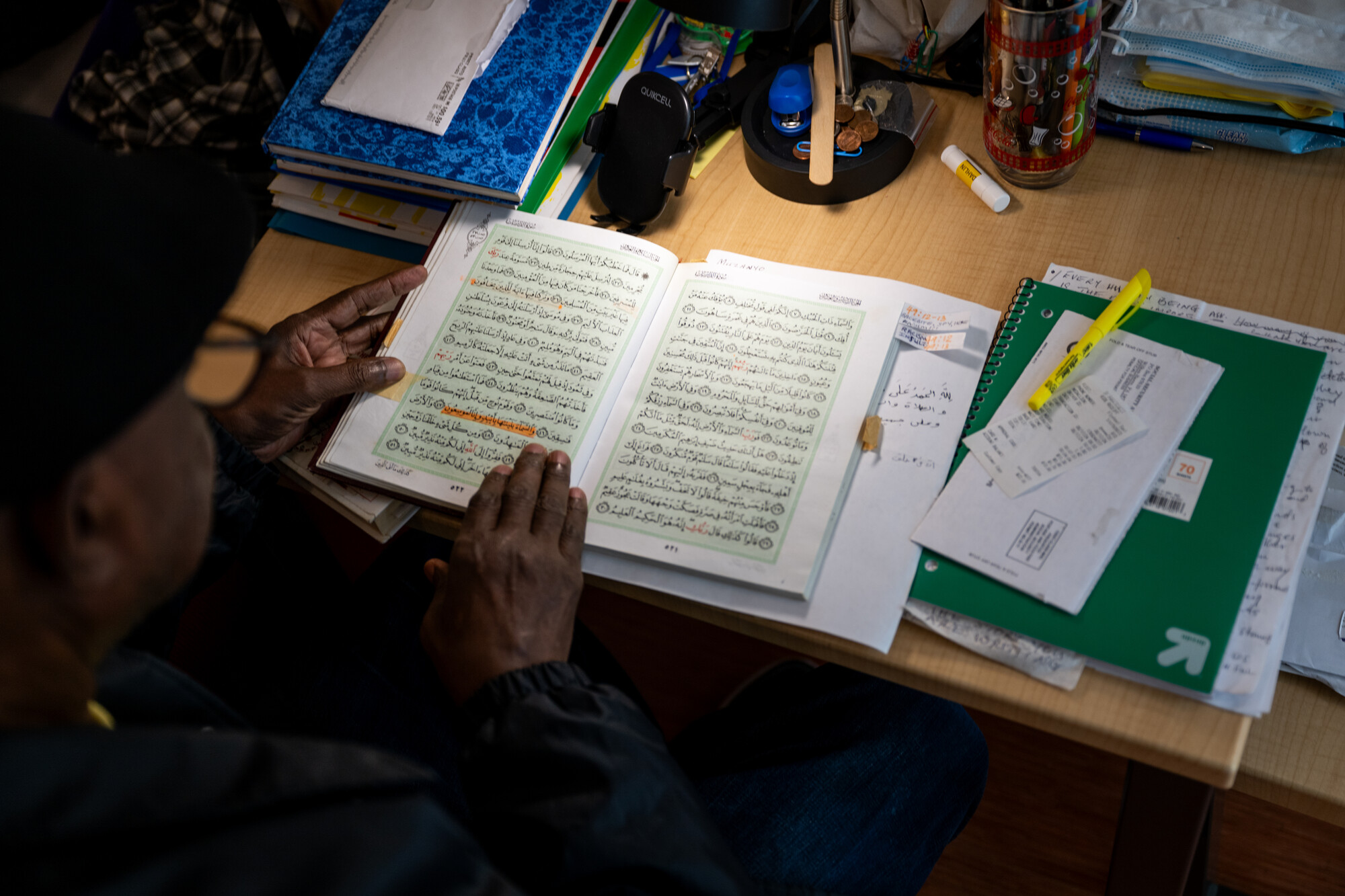

In many ways, Solomon Bukenya embodies the promise of permanent supportive housing.

He became homeless around 2007, living in cars and on the street in Texas and San Francisco. With high blood pressure and arthritis, his health was deteriorating.

One night about two years ago, when he had just arrived at 1066 Mission Street, a 100% supportive housing site for seniors in San Francisco’s South of Market neighborhood, his hands were so swollen and stiff that he couldn’t press the small button on the side of his prosthetic leg to remove it. He was alone and saw no other option but to call 911.

“I told them, ‘I can’t press this button. Please can you press it for me?’ And that’s all I wanted to do,” he said. “Imagine calling 911 for only that small thing?”

But in about two years of living at 1066 Mission Street, with access to regular health care and free meals, the now-65-year-old can walk, stand for long hours, and exercise regularly.

“I’m feeling [much] stronger,” Buckenya said. “I’m like a 20-, 25-year-old, the way I feel in my body.”

Research consistently shows supportive housing — like the kind Bukenya is receiving — leads not only to positive changes in residents’ lives, but to cost savings for taxpayers, too.

Xem thêm : US Federal Reserve Board announces new appointments to its Insurance Policy Advisory Committee

“It’s so much more affordable in comparison to incarceration or long-term hospitalization or literally the cost of one emergency room visit,” said Travis Hamilton, associate director of housing services for Episcopal Community Services, which operates Bukenya’s building.

It’s why housing advocates have pushed for this model to grow. Across the country, the number of these supportive apartments have more than doubled over the past decade — rising to nearly 663,000 housing units in 2023. In California, they’ve more than tripled.

But, as the number of these properties has grown, so, too, has the number of insurance claims, said Justin Dove, with the brokerage firm Gallagher. Dove said that’s why he thinks carriers are beginning to raise rates.

“There was a major influx of claim activity,” he said. “And, as most things happen in insurance, you have a high frequency period of claims, insurers start to retool, and they take action. Right? And so, their action has been increased premiums.”

But it isn’t just the volume of claims that have increased, it’s also the frequency of claims in supportive housing, compared to other forms of non-supportive affordable or market-rate housing, he said.

“We absolutely see a higher frequency of claims in those buildings,” Dove said.

A draft study out of Washington state (PDF) backs up his assessment. The authors, while noting some limitations in the data’s robustness, found “no evidence that current insurance rates in this segment are excessive, from an actuarial point of view.” That is to say, the authors found rates fairly reflected carriers’ risks.

Unforeseen consequences

On the day KQED visited Bukenya’s six-story apartment complex, evidence of that higher risk was on display: An elevator was out of service. A recent stove fire, while minor, had triggered the sprinkler system, sending water into the elevator shaft — causing an estimated $300,000 in damage.

Travis Hamilton, associate director of Housing Services at Episcopal Community Services, said it can be difficult for some residents — who have often spent a decade or more living outside — to transition to life inside an apartment.

“Folks take medication or they’re sleepy,” he said. “[They] leave the stove burner on, which can cause fires.”

Over the past two years, Episcopal Community Services has had six fires and eight floods across the roughly 1,650 apartments it operates in San Francisco and Marin counties, according to executive director Beth Stokes. Each accident, even minor ones, can cause tens of thousands of dollars in damages — especially if, as was the case in Buckenya’s apartment complex, the water leaks to the elevator or lower floors.

Stokes said it’s for that reason the organization’s last insurance carrier refused to cover several of its buildings that were over five stories tall.

Nor does it help that the properties are often located in neighborhoods with higher crime rates. With all of that combined, Stokes said the organization saw overall insurance premiums rise 34% last year.

“We’re seeing higher premiums, higher deductibles, lower coverage,” she said. “And when you have lower coverage, that’s a real risk.”

Emily Cohen, a spokesperson for San Francisco’s Department of Homelessness Services and Housing, said supportive housing providers pay, on average, about 20% more for insurance premiums than other non-supportive affordable housing providers in the city. The department oversees more than 13,500 apartments and rental vouchers throughout San Francisco.

Those increased insurance costs are coming on top of already-higher expenses to operate supportive housing, Cohen said. The buildings are often older properties that have greater maintenance needs; they require an on-site property manager and more support staff; the units come furnished and residents don’t pay as much toward their security deposits as non-subsidized tenants, she said.

“So it gets to be a lot,” Cohen said. “And, we have very minimal rent revenue coming into the properties as the rents are always income-based.”

Sustaining the model

Insurers, meanwhile, say costs are piling up for them, too.

Collins, with the American Property Casualty Insurance Association, said inflation has hit the construction industry particularly hard, which has increased rebuilding costs. Add to that the increase in natural disasters, plus construction growth in areas at higher risk of natural disasters, and Collins said the industry has been stretched thin.

“This is a trend that we’re unfortunately seeing across a number of states,” Collins said.

California’s Insurance Commission is in the process of approving changes to address some of the state’s climate-change related challenges, including a change that went into effect on Friday, allowing insurers to use catastrophe modeling in exchange for promises to write more policies in risky wildfire areas.

But carriers won’t be able to put them into practice until they get their rates approved by the commission — a process that Collins said has historically taken, on average, more than a year, though there are efforts by the commission to speed it.

Once the new rates are in place, Collins said that would help bring insurers back to the state, but may not lower costs for supportive housing providers.

“These insurance premiums today are not overcharging; they’re reflecting actuarially what that risk is,” she said.

What can help, Collins said, is better mitigation measures, such as more interior controls to prevent floods, fires and other resident-caused damages.

At Episcopal Community Services, some of those measures are already in place. The building at 1066 Mission Street, which opened in the fall of 2022, has an extra drain in the bathroom so water doesn’t pool on the floors, Hamilton said. And there are built-in timers to automatically shut off stove tops.

But, Stokes said, they could use additional staff, especially during nights and weekends, to provide more support to residents and respond more quickly when incidents do occur. And, additional operating subsidies from federal, state and local governments to account for the higher insurance premiums.

Without those subsidies, she said providers likely won’t be able to develop or manage new buildings for the tens of thousands of unhoused people waiting for a home — and may even risk losing the ones they already have.

“We all want more units, but not at the cost of losing units,” she said. “We’re all very concerned about the sustainability of the model.”

Nguồn: https://propertytax.pics

Danh mục: News