South Korea life insurance sector to hit $157.9bn by 2029

January 2, 2025

- ‘It doesn’t change your everyday business’

- California will require insurers to offer home coverage in wildfire-prone areas | California

- Roofing company barred from acting as insurance adjuster • Iowa Capital Dispatch

- Health insurers limit coverage of prosthetic limbs, questioning their medical necessity

- Division of Insurance recovers more than $9.4M for Nevadans in 2024

Bạn đang xem: South Korea life insurance sector to hit $157.9bn by 2029

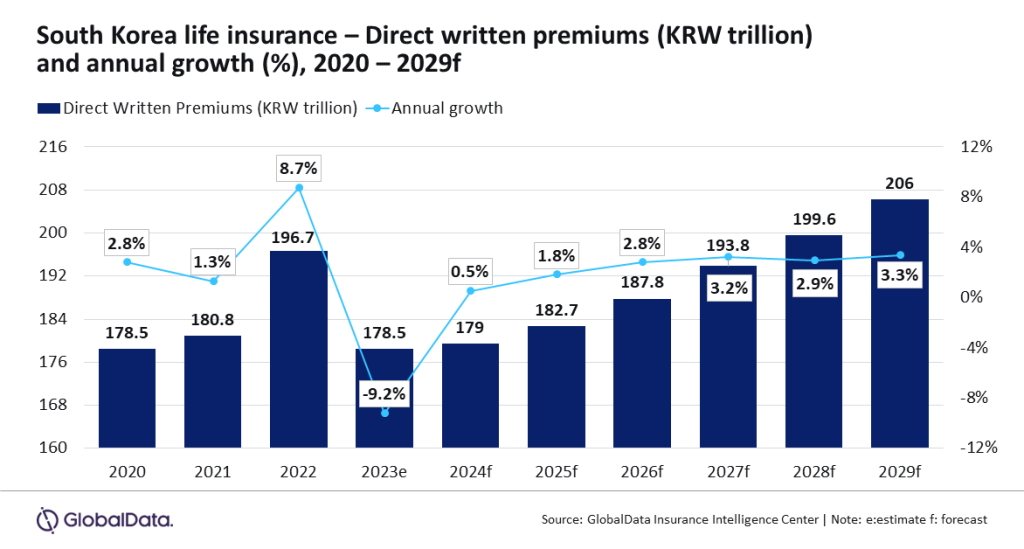

The life insurance sector in South Korea is predicted to grow at a CAGR of 3.1% from KRW182.7trn ($139.8bn) in 2025 to KRW206.2trn ($157.9bn) in 2029, in terms of direct written premiums.

This is according to GlobalData, which also forecast that the life insurance industry in South Korea will regain momentum in 2024 and 2025 after declining by 9.2% in 2023.

Prasanth Katam, insurance analyst at GlobalData, said: “The South Korean economy witnessed a slower growth of 1.4% in 2023 that affected the demand for life insurance products. GlobalData expects the economy to rebound and grow by 2.2% in 2024 and 1.8% in 2025, which will support the demand for long-term and pension products.”

Pension insurance is the largest line of business, which is expected to account for a 39.7% share of the direct written premiums in 2024.

In addition, it grew by 4.7% in 2024, driven by stable market conditions, leading to higher returns on investments.

The National Pension Service in South Korea reported a preliminary return of 9.2% on its investments, amounting to KRW97trn ($70bn) during the first nine months of 2024.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Xem thêm : Alliant Insurance Services Appoints Ben Guttenberger as Vice President

Company Profile – free

sample

Thank you!

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Furthermore, the increase is largely attributed to strong performance in its foreign equity holdings, prompting individuals to invest more funds in their pension plans. Pension insurance is expected to grow at a CAGR of 4.7% over 2025–29.

Whole life insurance is the second-largest line, with an estimated share of 12.4% of the direct written premiums in 2024. It is expected to grow at a CAGR of 1.2% over 2025-29, largely driven by changing demographic factors.

Katam added: “The South Korean life insurance industry is poised for steady growth, driven by economic recovery and changing demographics that are contributing to the demand for long-term care and pension solutions. The changing market dynamics will prompt insurers to offer policies for the aging population, which are likely to contribute to the industry’s growth over the next five years.”

Nguồn: https://propertytax.pics

Danh mục: News